Why Smart Money Moves Make or Break Your Business Travel

Look, business travel isn’t just about hopping on a plane and closing deals anymore. It’s a full-on juggling act — managing your schedule, your energy, and yeah, your money. And if you don’t get your travel finances nailed down, the whole trip can spiral into one massive headache. You’ve been there: scrambling for cash at some sketchy airport ATM, dealing with surprise fees on your card, or stressing over whether your budget will cover that last-minute dinner invite. So here’s the thing: travel money matters. You gotta lock in your foreign currency before you even touch down. Waiting to exchange cash at the airport?

That’s rookie stuff. Those kiosks and ATMs?

They’re basically there to rip you off with sky-high fees and lousy rates. Instead, order your currency ahead of time through your bank or a trusted online service—and keep an eye on exchange rates with a handy app. A little timing can stretch your travel budget further, and honestly, it keeps you from sweating the small stuff on a tight schedule. And don’t just set a daily budget—pad it by at least 20%.

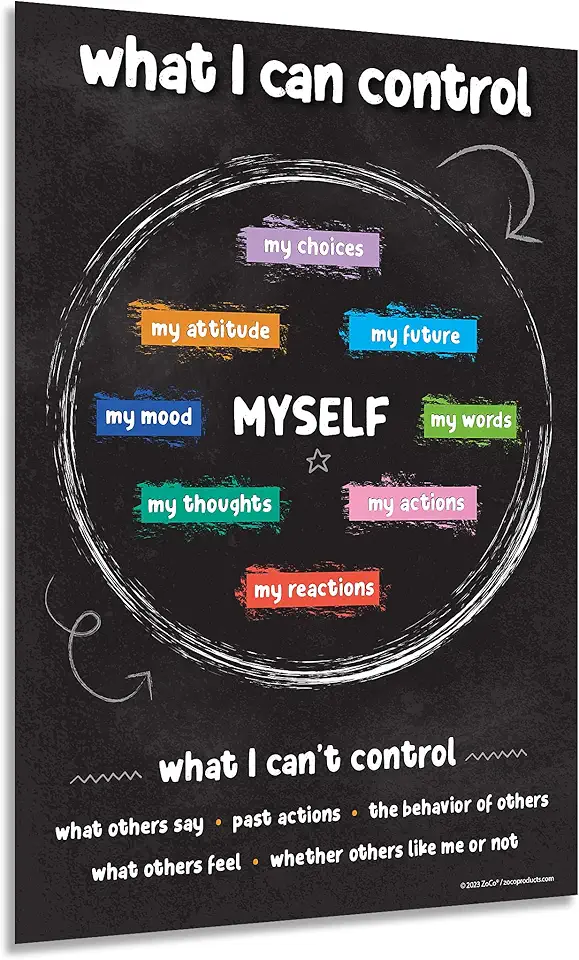

Business trips are notoriously unpredictable. One meeting turns into two, or a flight delay means an extra hotel night. Those random expenses add up faster than you think: Wi-Fi fees, printing costs, cabs, coffee runs, tips, you name it. Here’s a quick hack: use cash for small purchases. Studies show people spend less when handing over real bills, not plastic. It’s a simple way to stay mindful and avoid financial burnout on the road.

Choose Your Financial Tools Like a Pro

Let’s be real—credit cards can either be your best friend or your worst enemy when traveling. If your main card still charges foreign transaction fees, it’s time to upgrade. Find a travel-friendly card that offers no foreign fees, some travel insurance, and perks like lounge access or cash back on business spending. And don’t forget to notify your bank before you leave. Nothing kills productivity like getting locked out of your account because of a flagged charge in a foreign city. Oh, and use tech to your advantage. Mobile wallets like Apple Pay or Google Pay are accepted all over these days and make life easier without lugging around wads of cash. Expense tracking apps like Expensify or Concur let you snap receipts and organize spending on the fly. This isn’t just about convenience—it’s about freeing your brain to focus on the work that really matters, not scrambling to find receipts at the airport gate.

Build a Travel Emergency Fund and Budget for Real Moments

Here’s a nugget of wisdom: build a separate emergency fund just for travel. Flights get delayed, bookings get canceled, bags get lost—these things happen, and when they do, you don’t want to be scrambling to max out your credit card or dip into your regular savings. Keep that fund separate, maybe on a prepaid travel card or a digital wallet. It’s your safety net, your peace of mind, and trust me, it pays off big time. Speaking of spending, don’t just budget for taxis and hotel rooms. Budget for the stuff that actually makes a trip worth it—those coffee chats, team dinners, or local events where real connections happen. Business breakthroughs rarely come from a sterile conference room. You’ve got to build space for culture, conversation, and connection if you want to turn a trip into something meaningful—and that means spending smart, not just tight.

Starting Your Own Business Means Planning Like a Shark

Now, take all that travel hustle and think bigger—starting your own business. The dream of launching your own venture?

It’s easy to romanticize. But the reality?

It’s a grind, filled with legal hoops, market research, and endless decisions that determine if you sink or swim. You’re not just selling a product or service—you’re building a whole machine from the ground up. The smartest entrepreneurs swear by checklists. And not just any list, but a step-by – step game plan that covers everything from that first “aha” moment to legal structures, market validation, and daily operations. Miss a step here, and you might face costly mistakes down the road—trust me, I’ve seen it happen too many times. It’s not glamorous, but it’s essential. The payoff?

Well-organized, scalable growth without nasty surprises.

Nail Your Idea and Know Your Market Like a Boss

Before you even think about launching, you gotta nail your business idea. Is it a product?

A service?

What unique skills or passions do you bring to the table?

Be honest with yourself—and the market. This is where research turns from hand-waving into hard facts. Surveys, focus groups, interviews—dig deep. Find out who your customers really are, what they want, and if they’re willing to pay for it. Don’t skip competitor research either. If your market is already saturated with companies that have it locked down, you need to rethink your angle or pivot. Launching without knowing your competition is like stepping into a boxing ring blindfolded. Pro tip: build a minimum viable product (MVP).

Get a stripped-down version of your offering out there and see how the market reacts before you blow all your cash on a full launch. It’s lean, it’s smart, and it saves you from betting everything on untested ideas.

Why Planning Your Finances and Business Go Hand in Hand

Here’s the bottom line: whether you’re jet-setting for work or launching your own business, managing your money isn’t a side hustle—it’s the backbone of your success. And it’s more than just dollars and cents; it’s about mindset, resilience, and smart habits that keep you steady when the unexpected hits. Look, I get it. Travel and entrepreneurship can be messy, unpredictable, and downright stressful. But with a little preparation—locking in currency, padding your budgets, choosing the right financial tools, and building emergency buffers—you’re not just surviving the chaos, you’re owning it. Same goes for business: nail your idea, know the market, and don’t skip the homework. That’s how you turn hustle into growth and stress into confidence. So next time you’re boarding that plane or sketching out your business plan, remember: it’s all connected. Smart money moves on the road prepare you for smart decisions at home—because at the end of the day, your financial savvy is your secret weapon, whether you’re closing deals overseas or building your empire from scratch. And that’s a wrap. – – – If you want to dig deeper into mastering business travel or jumpstart your entrepreneurial journey, check out resources like Success.com’s financial wellness guides, travel budgeting tools like Expensify, and comprehensive startup checklists that can save you from rookie mistakes before they happen. Trust me, your future self will thank you.